run.events - Pioneering Fiscalization for the Event Industry

January 26, 2024 • 2 min read • By Adis Jugo, President at run.events

In the ever-evolving landscape of fiscal compliance, run.events stands at the forefront as the first Event Management Platform to fully support fiscalization and real-time fiscal reporting. This groundbreaking feature is a game changer for event organizers, attendees, and the event industry at large, particularly in the ever-growing number of European countries where invoice fiscalization and real-time reporting are mandatory.

Why Fiscalization Matters in the Event Industry

Fiscalization, the process of electronically recording and validating financial transactions for taxation purposes, as well as its direct and real-time reporting to tax institutions, is vital for ensuring compliance with diverse tax regulations across Europe. Different countries have adopted various fiscalization methods, be it hardware, software, a combination of both, or purely online systems.

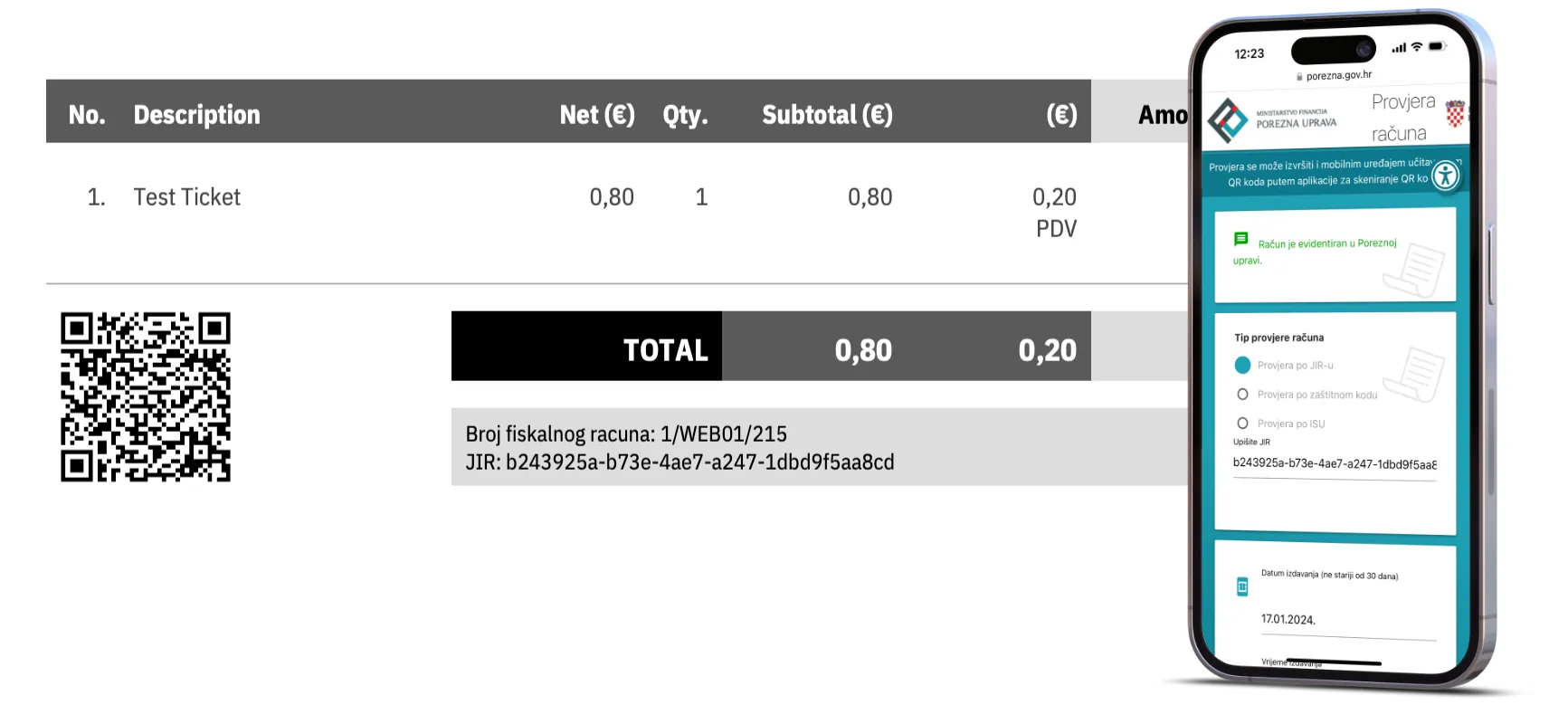

Also, an ever-growing number of countries require real-time invoice fiscalization and reporting, which means that issued invoices must be reported to the tax authorities the moment they are issued, and that a fiscalization ID issued by the tax authority must be printed on the invoice itself.

This impacts all invoices issued to event attendees, which are paid by any means other than wire transfer. Invoices paid by credit card payments, various online payment services, as well as cash-on-entrance, are all subject to fiscalization and real-time reporting for the event organizers who are organizing events in the countries which adopted this approach. And the number of countries going down this path in Europe and otherwise is increasing year after year.

Learn how you can issue VAT-compliant invoices, invoice cancellations and invoice corrections with run.events

run.events’ Fiscalization Support and the Real-Life Results

run.events fully supports fiscalization in the countries which opted for software and online fiscalization, and it’s a game changer the event industry and event organizers particularly in Europe. We are setting a new standard in event technology, one that prioritizes compliance, efficiency, and security. run.events is not just keeping pace with the evolving fiscal landscape: we are actively shaping the future of event industry in Europe by ensuring that all financial transactions are instantly and accurately recorded, streamlining administrative tasks and reducing the risk of non-compliance with tax laws.

The first event benefiting from run.events fiscalization support is the Automation Summit in Croatia. Organizers are using their own fiscalization certificates in conjunction with run.events platform to issue and sign fiscal invoices for all their attendees who are paying for their tickets with their credit cards or online payment providers. The event organizers, company Robotic Process Automation from Zagreb, Croatia, don’t have to use separate systems to issue invoices for the tickets sold through run.events – the process is now covered from end to end, and the attendee’s event ticket

Does Anything Change for the Event Attendees?

Attendees, too, will benefit from this advancement. The seamless integration of fiscalization into the event management process means quicker and smoother transactions. This efficiency instills confidence in attendees, knowing that their financial interactions are handled securely and in compliance with relevant tax regulations.

Conclusion

In conclusion, the integration of fiscalization support into run.events is a significant step forward for the event industry in Europe and elsewhere. It addresses the critical need for compliance with diverse fiscal regulations and real-time reporting while enhancing the experience for both organizers and attendees. As the landscape of fiscalization continues to evolve, run.events remains committed to providing innovative solutions that meet the challenges of today and tomorrow.