Simplifying E-Invoicing for Events: Compliance with EN16931, ZUGFeRD, and Factur-X

January 7, 2025 • 4 min read • By Margit Jugo, Chief Financial Officer

Full Compliance with EN16931, ZUGFeRD, and Factur-X.

In the fast-paced world of event management, financial operations need to be as seamless as ticketing, networking, and logistics. That’s why run.events has integrated fully compliant e-invoicing solutions that align with international and European standards, ensuring your event finances are smooth, automated, and compliant.

If you’re an event organizer handling large-scale transactions, you already know that traditional invoicing methods can be inefficient, error-prone, and difficult to track. With growing legal requirements across Europe and beyond, event organizers need a future-proof solution—and that’s exactly what run.events provides.

What Are EN16931, ZUGFeRD, and Factur-X?

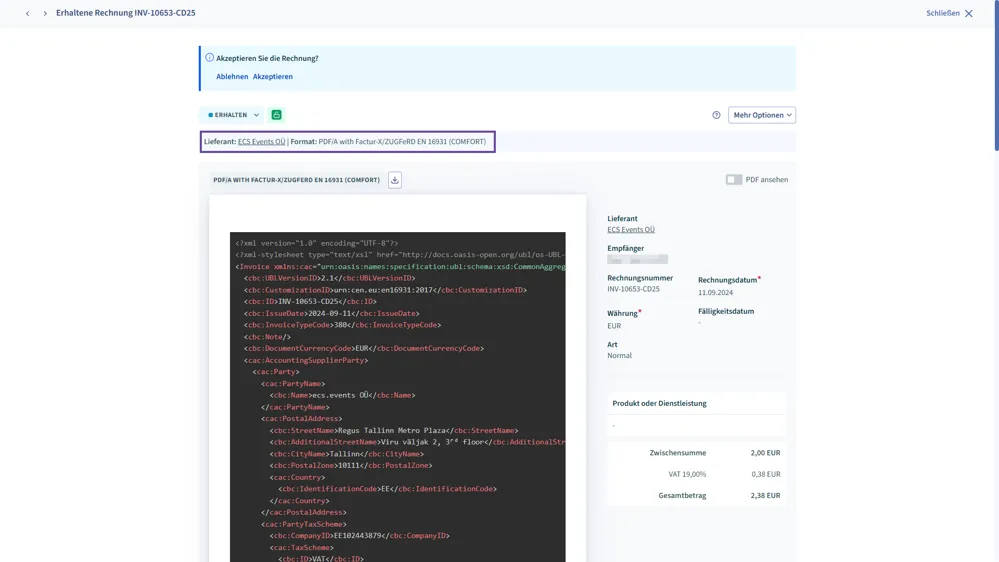

E-invoicing isn’t just about digitizing paper invoices. It involves structured data formats that enable automation, compliance, and interoperability between businesses and tax authorities.

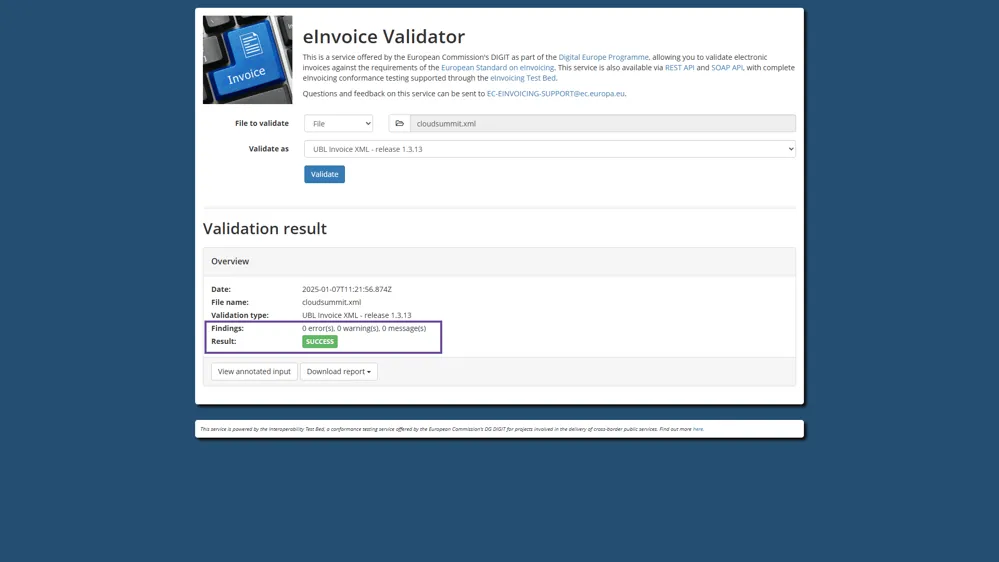

✅ EN16931: The European standard for electronic invoicing, ensuring that invoices are legally valid across EU countries.

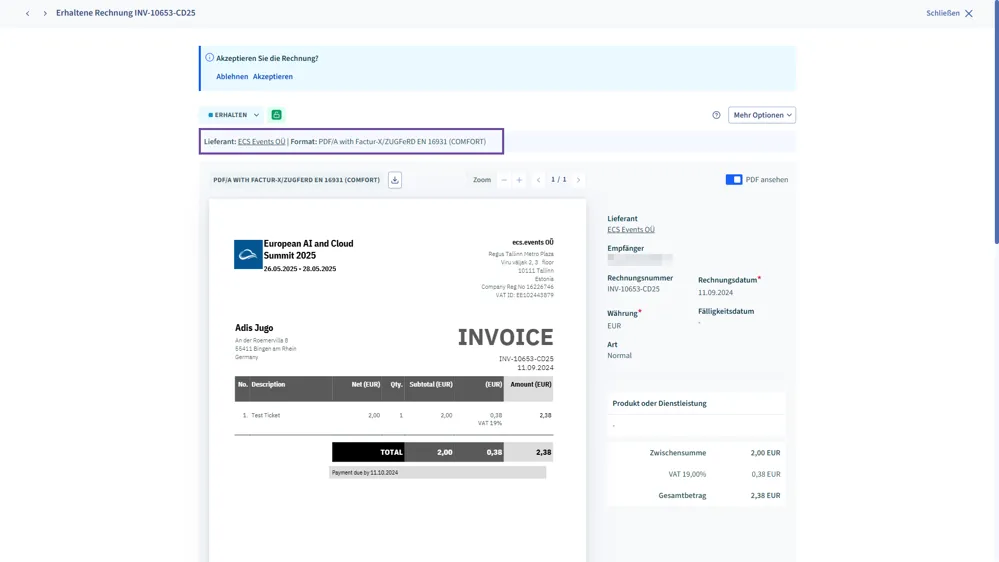

✅ ZUGFeRD: A German standard combining human-readable PDFs with structured XML data for easy processing.

✅ Factur-X: The French equivalent of ZUGFeRD, allowing invoices to be read by both humans and machines.

These standards streamline invoicing workflows, reduce administrative effort, and ensure tax compliance across different countries and systems.

How run.events Supports E-Invoicing Standards?

At run.events, we recognize the importance of accurate and automated invoicing. Our platform seamlessly integrates these standards to offer a fully digital, regulation-compliant invoicing experience for event organizers, exhibitors, and sponsors.

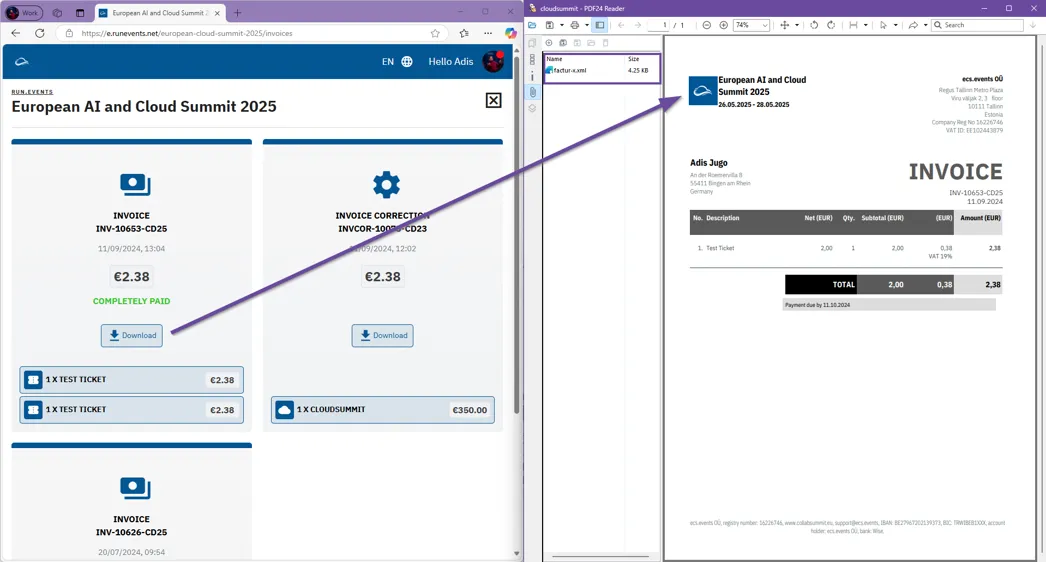

1. Automated, Compliant Invoicing

With run.events, invoices are automatically generated in compliance with EN16931, ZUGFeRD, and Factur-X. Whether your attendees or partners need machine-readable structured data or a traditional PDF invoice, our system creates both formats simultaneously, ensuring seamless processing by financial systems and government portals.

2. Secure Digital Invoices for Hassle-Free Tax Compliance

Run.events ensures that every invoice issued meets tax regulations by embedding structured XML data inside PDFs. This guarantees that invoices can be automatically validated, stored, and transmitted according to local and international tax regulations—reducing risks of non-compliance.

3. Direct Integration with Payment Processing and VAT Reporting

Our finance module is built to connect directly with payment processors, ensuring that every transaction is correctly recorded and invoiced. Additionally, real-time VAT reporting makes tax submissions easy, whether you’re handling multiple tax rates, reverse charges, or cross-border transactions.

4. One-Click Invoice Delivery and Export

Forget manual invoice management. With run.events, you can:

✅ Automatically send e-invoices via email in compliant formats.

✅ Export invoices for external accounting software or tax authorities.

✅ Track payment status and automate reminders for unpaid invoices.

This means your event finances stay organized, transparent, and audit-ready—without the headaches.

Why Switch to run.events for E-Invoicing?

AMoving to a fully integrated event management & invoicing platform like run.events is a game-changer. Unlike outdated invoicing tools or third-party services, we offer:

✅ Built-in compliance with EN16931, ZUGFeRD, and Factur-X—no extra setup required.

✅ Instant e-invoice generation and delivery for sponsors, exhibitors, and attendees.

✅ Full integration with ticket sales, sponsorship payments, and financial reporting.

✅ Multi-country tax compliance, ensuring every invoice meets local regulations.

With run.events, your entire event financial workflow becomes easier, faster, and legally compliant—allowing you to focus on delivering outstanding events.